hawaii capital gains tax worksheet

Capital Gains Worksheet 2016. State of Hawaii Department of Taxation PO.

83 rows Capital Gains and Losses and Built-in Gains Form N-35 Rev.

. In Hawaii capital gains on real estate are subject to a 75 tax. 481 E-fi le Form N-11. Hawaii Financial Advisors Inc.

Worksheet For Capital Gains And Losses. Worksheet For Capital Gains And Losses. House members take their oaths of office on.

Net gains and losses carry either to Form N-35 page 1 or to Schedule K as appropriate. Postage PAID Honolulu Hawaii Permit No. Place an X if tax from Forms N-2 N.

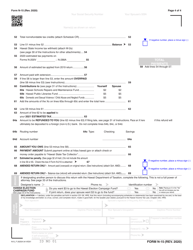

Hawaii Capital Gains Tax Table. About the Author Marilyn Crawford. On line 8 of the Form N-11 worksheet or line 2 of the Form N-15 Capital Gains Tax Worksheet INSTRUCTIONS.

Short-term capital gains are taxed at ordinary income. Hawaii Capital Gains Tax Worksheet. Capital Gains And Losses Worksheet Instructions.

Short-term capital gains are taxed at the full income tax rates listed above. Child Support Guidelines Worksheet Hawaii 2010. Capital Gains Worksheet 2017.

481 E-fi le Form N-11. Capital Gains Tax Worksheet Irs. The amount of net capital gain as shown on Schedule O page 2 line 31b is taxed at the rate of 4.

Box 3559 Honolulu Hawaii 96811-3559 PRSRT STD US. Capital Gains Worksheet Real Estate. Capital Gains And Losses Worksheet Example.

Income from nonunitary business activities conducted within Hawaii royalties and rentals from property owned within Hawaii and intangibles having a business situs in Hawaii must be allocated to Hawaii. The tax rules governing profits you realize from the sale of your home have changed in recent years. 21 Gallery Of Hawaii Capital Gains Tax Calculator.

Hawaii Capital Gains Tax Worksheet. Excel Worksheet To Worksheet. Capital Gains Tax Worksheet Line 44.

However on line 1 of the Form N-11 or Form N-15 worksheet enter the amount from Form N-615 line 4. Box 3559 Honolulu Hawaii 96811-3559 PRSRT STD US. Hawaii Capital Gains Tax Table.

Hawaii Capital Gains Tax Worksheet. Capital gains result when an individual sells an investment for an amount greater than their purchase price. 28 Capital Gains Tax Rate Worksheet.

Worksheet For Capital Gains And Losses. Capital Gains And Losses Worksheet Example. Hmrc Capital Gains Tax Calculator Non Resident.

Or Capital Gains Tax Worksheet on page 41 of the Instructions. Use our capital gains calculator to determine how much tax you might pay on sold assets. 21 Gallery Of Real Estate Capital Gains Tax Worksheet.

State of Hawaii Department of Taxation PO. 21 Gallery Of Hawaii Capital Gains Tax Table. Hmrc Capital Gains Tax Calculator.

Capital Gains Worksheet Ato. Add Worksheet With Vba. E-fi le Form N-11 through Hawaii Tax Online the Departments website.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. If the Capital Gains Tax Worksheet is used to figure the tax follow the steps in the instructions for line 9 on page 1. Capital Gains Tax Worksheet Ato.

Lori Bryant April 25 2021. Hawaii Schedule D - Capital Gains and Losses and Schedule D-1 - Supplemental Schedule of Gains and Losses are prepared from entries on federal sale of asset input. 21 Gallery Of Hawaii Capital Gains Tax Worksheet.

You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. For more information go to. Hawaii Capital Gains Tax Calculator.

2021 STATE OF HAWAIIDEPARTMENT OF TAXATION Capital Gains and Losses 2021 Attach this Schedule to Fiduciary Income Tax Return Form N-40 Name of Estate or Trust PART I N40SCHD_I 2021A 01 VID01 Federal Employer Identification Number Short-term Capital Gains and Losses Assets Held One Year or Less a. Hawaii Capital Gains Tax Calculator. Hawaii Capital Gains Tax Table.

Hawaii Capital Gains Tax Calculator. Individual Income Tax Return Resident Form N-11 Rev. Clear Form SCHEDULE D FORM N-40 REV.

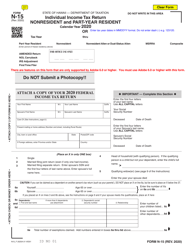

Child Support Guidelines Worksheet Hawaii. Download or print the 2021 Hawaii Form N-15 Individual Income Tax Return Nonresidents and Part Year Residents for FREE from the Hawaii Department of Taxation. Capital gains are categorized as short-term gains a gain realized on an asset held one year or less or as long-term gains a gain realized on an asset held longer than one year.

2021 Individual Income Tax Return Resident FORM N-11 Rev. Excel Worksheet Within A Worksheet. Hawaii Capital Gains Tax.

Allocation of capital gains and losses. Posts Related to Hawaii Capital Gains Tax Worksheet. Hmrc Capital Gains Tax Worksheet.

Capital Gains Tax Worksheet is used to figure the tax. 28 Percent Capital Gains Worksheet. 28 Capital Gains Tax Rate Worksheet.

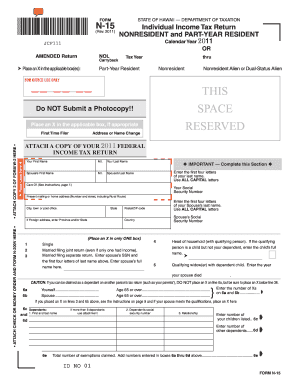

Capital Gains And Losses Worksheet Example. 2021 STATE OF HAWAII DEPARTMENT OF TAXATION N11_I 2021A 01 VID01 MM OR DD YY Fiscal Year Beginning AMENDED Return NOL Carryback IRS Adjustment First Time Filer and Ending MM DD Your First Name MI. Howard Hopkins April 25 2021.

Place an X if from. Hawaii State Tax Collector For more information see page 30 of the Instructions. E-fi le Form N-11 through Hawaii Tax Online the Departments website.

Hawaii State Tax Collector For more information see page 26 of the Instructions. 28 Capital Gains Tax Rate Worksheet. You will receive 25 of the sales price.

Increases the capital gains tax threshold from 725 to 9. Eugene Payne April 25 2021. Applies for tax years beginning after.

Hawaii Capital Gains Tax Worksheet. Increases the alternative capital gains tax for corporations from 4 to 5. Capital Gains Worksheet Real Estate.

Hmrc Capital Gains Tax Worksheet. Postage PAID Honolulu Hawaii Permit No. Hawaii Capital Gains Tax Worksheet.

Capital Gains And Losses Worksheet Example. Real Estate Capital Gains Tax Worksheet. 28 Percent Capital Gains Worksheet.

Earned Income Credit Worksheet Eic Worksheet. 745 Fort Street Suite 1614. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries.

Worksheet For Capital Gains And Losses. Capital gains tax rates on most assets held for less than a year correspond to. Hawaii Boarding Pass Wedding Invitations.

Use this calculator to estimate your capital gains tax. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. For more information go to.

Hawaii Capital Gains Tax Worksheet. Taxable Income 43 44 Tax.

Form N 15 Download Fillable Pdf Or Fill Online Individual Income Tax Return Nonresidents And Part Year Residents 2020 Hawaii Templateroller

Qualified Dividends And Capital Gains Worksheet Pdf 2016 Form 1040line 44 Qualified Dividends And Capital Gain Tax Worksheetline 44 Keep For Your Course Hero

Form N 11 Fillable Individual Income Tax Return Resident Filing Federal Return

Qualified Dividends And Capital Gains Worksheet Pdf 2016 Form 1040line 44 Qualified Dividends And Capital Gain Tax Worksheetline 44 Keep For Your Course Hero

Form N 11 Fillable Individual Income Tax Return Resident Filing Federal Return

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Tax Hawaii Gov Forms Nonresident N 15 2011 Fill Out And Sign Printable Pdf Template Signnow

Form N 15 Download Fillable Pdf Or Fill Online Individual Income Tax Return Nonresidents And Part Year Residents 2020 Hawaii Templateroller

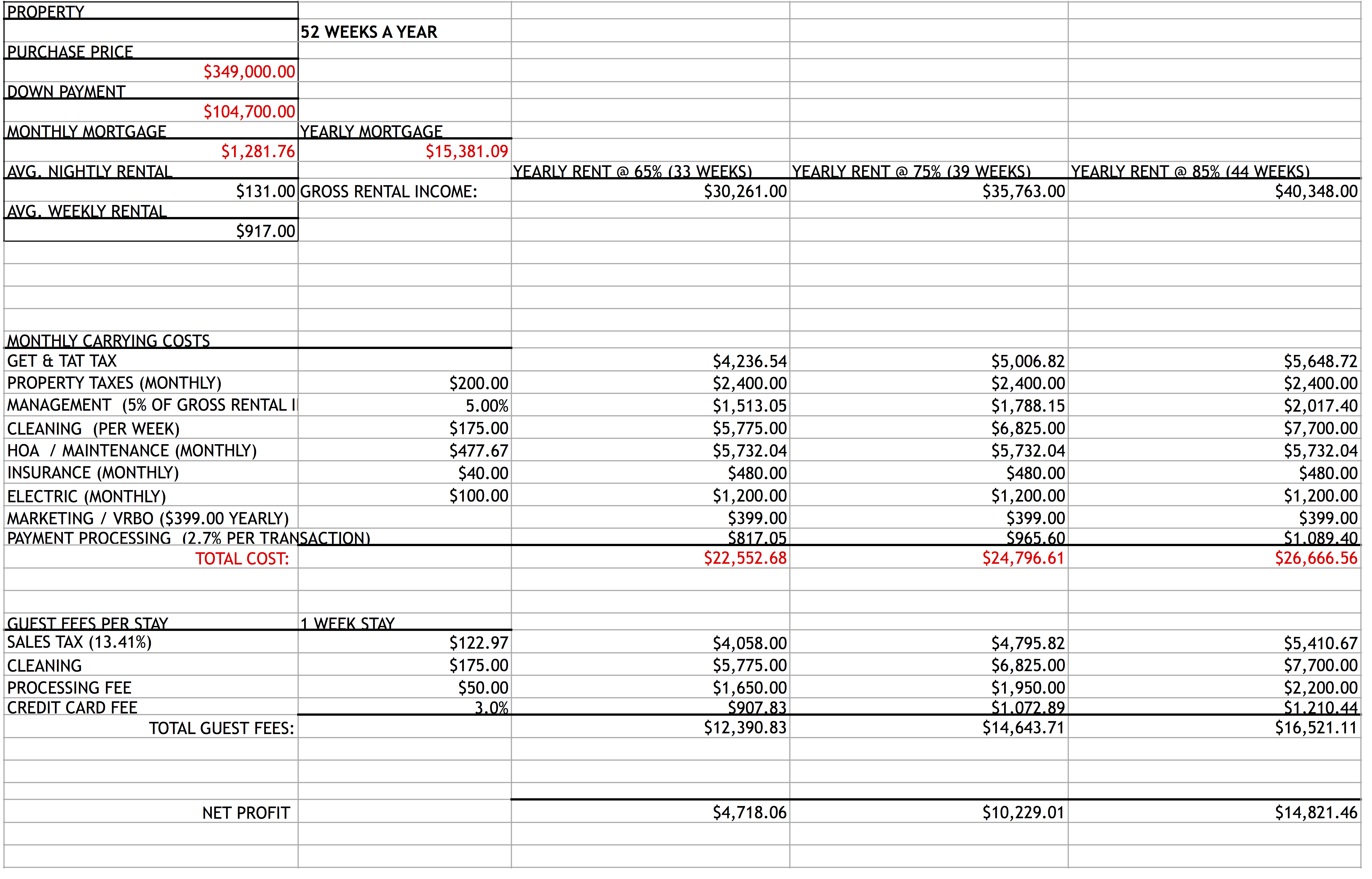

Toolkit For Purchasing Hawaii Vacation Rental Property

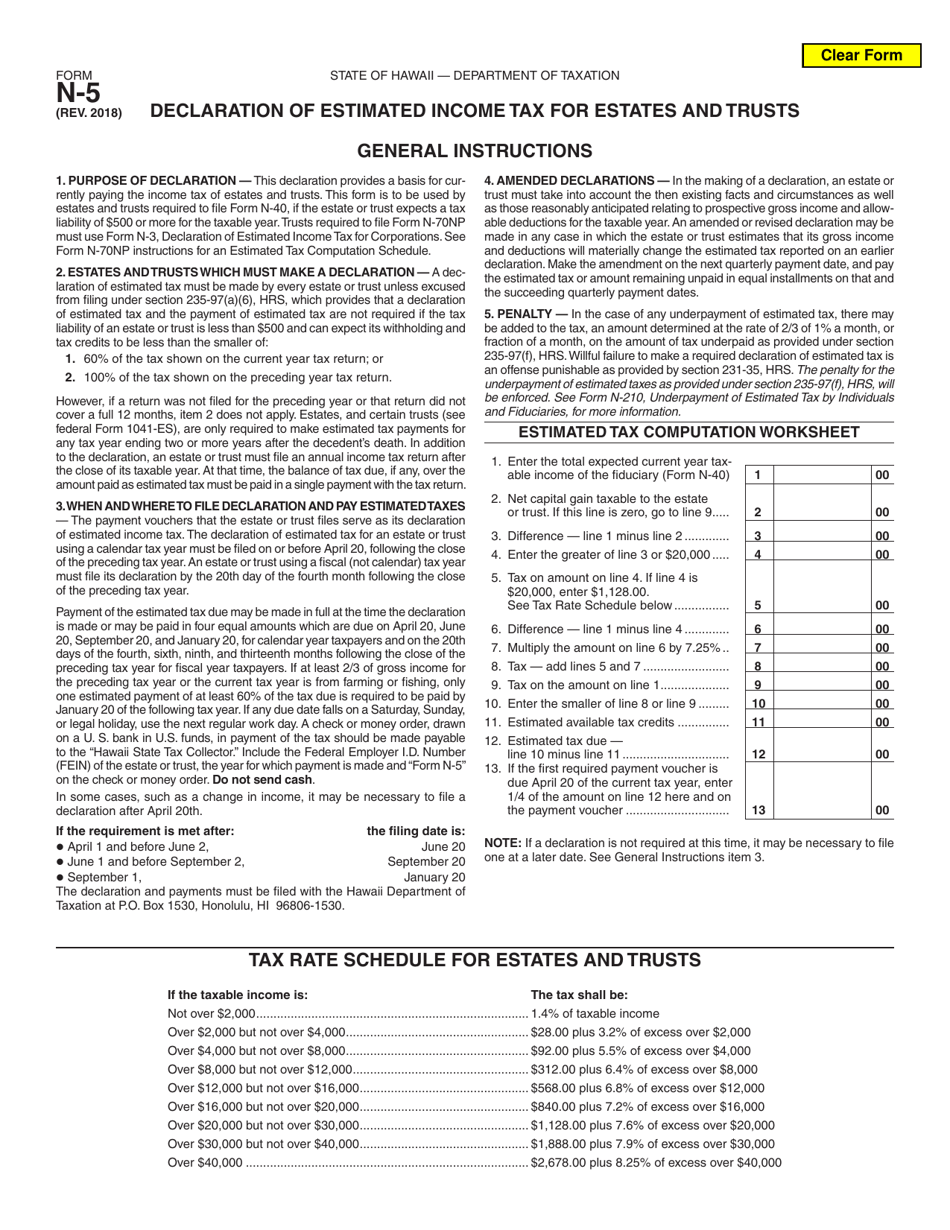

Form N 5 Download Fillable Pdf Or Fill Online Declaration Of Estimated Income Tax For Estates And Trusts 2018 Templateroller

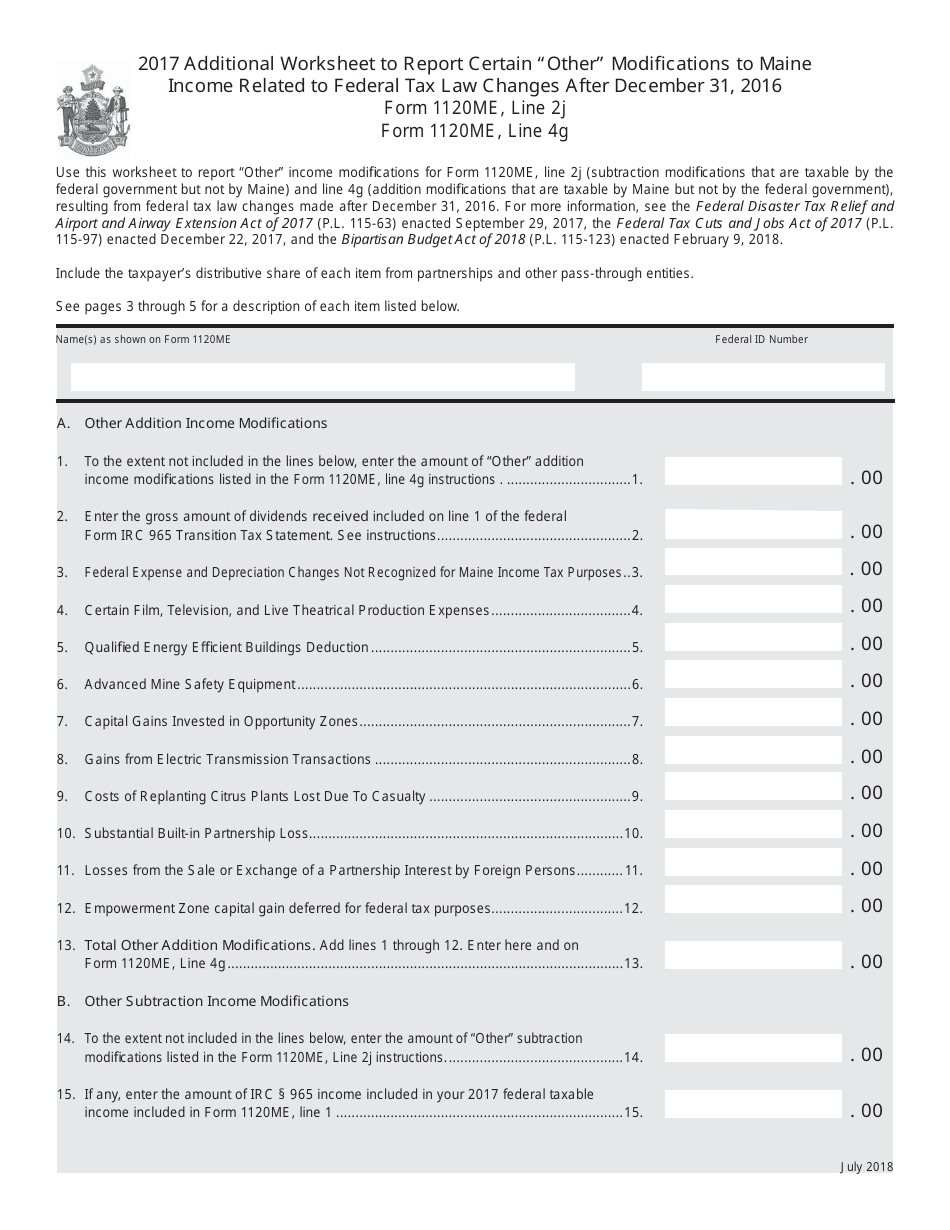

Form 1120me Download Printable Pdf Or Fill Online Additional Worksheet To Report Certain Other Modifi Cations To Maine Income Related To Federal Tax Law Changes After December 31 2016 2017 Maine Templateroller